External assessors who works as private individuals

These guidelines apply to foreign assessors who works as a private individual

Registration

The first time you perform an assessment for NA you need to fill out a registration form so that we can register you into our payroll system.

Tax deduction card

Before you arrive in Norway to do your first assessment it is important that you book an appointment at the Norwegian Tax Administration. Before you can get a tax deduction card in Norway you need to meet in person for an ID control.

It is very important that you remember to ask for an accesss to MinID when you are at the Norwegian Tax Administration.

Tax deduction is done based on the tax deduction card that NA obtains from the Norwegian Tax Administration. Those who have not applied for a tax deduction card will be subject to a 50 % advance tax deduction.

Payments

You need access to the Betalmeg app in order to send your travel expense clailms and reimbursements. To get access you need to have a Norwegian BankID or MinID. After you send the registration form to regnskap@akkreditert.no, we will order the Betalmeg access to you. It will take a few days from the time we order until you get access. Once your user has been created, you receive an e-mail from DFØ, which delivers the Betalmeg solution for Norwegian Accreditation.

The e-mail will contain some information about how to log in and what is important to keep in mind. If you don't receive an email, please check your spam filter.

Logging into “Betalmeg”

Here’s how:

- Go to The Directorate for Financial Management (DFØ) self-service solution and log in to Betalmeg – self-service online, or

- Download the DFØ app.

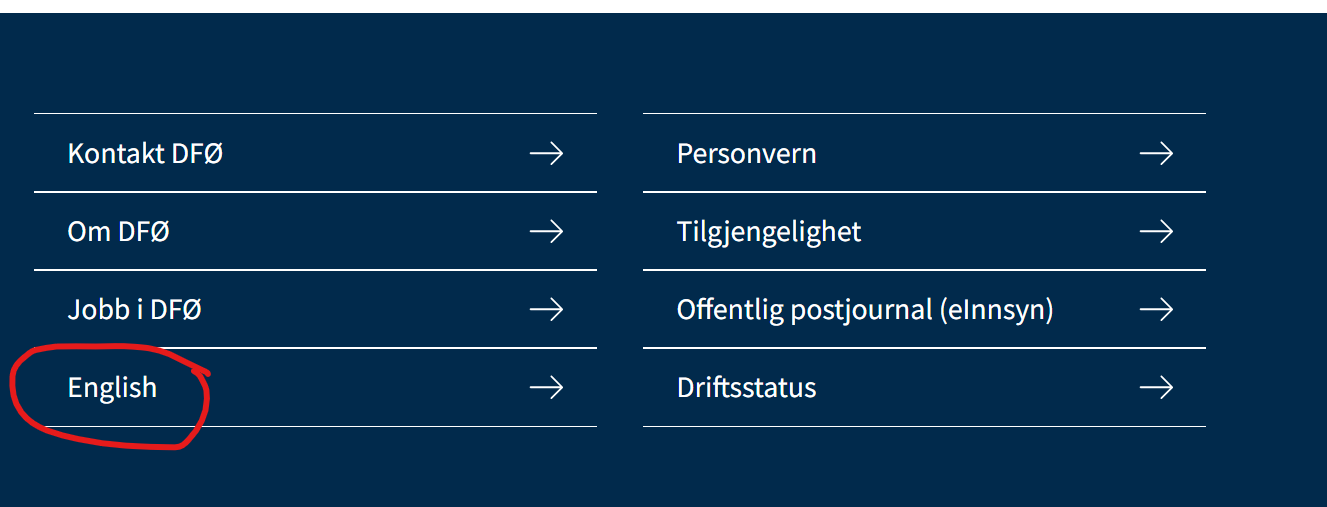

You will find a lot of helpful information when you log into the “Betalmeg” online solution. The chatbot Lara provides assistance and guidance. On DFØ’s website, you will find detailed guides, including links to videos on how to use Betalmeg. At the bottom of the page, you can choose to have the pages tranlated to English.

For questions about the assignment itself or administrative matters related to it, please contact Norwegian Accreditation. If you have problems with logging in or functionality, please contact DFØ’s customer center:

Fees and travel expenses are paid out in accordance with the assignment contract and approved completion of the assignment. After the completion of the assignment, you need to fill out the Time specification – external assessor. If you have had travel expenses please read our guidelines and send the travel expenses in the Betalmeg app.

Please make a reference to the accreditation number and case number in all the forms and in the e-mail heading.

After your claim has been approved, it will be included in the next round of payments on the payment schedule.

Payment to foreign account

Payments to overseas bank accounts using IBAN and SWIFT/BIC addresses take 2-3 days longer than payments within Norway.